Securities, commodity contracts, and investments

Industry profile, February 2020

Sections: Description | Pricing | Costs | Demand | Appendix

This page is an industry profile for the Securities, commodity contracts, and investments industry. It provides a general economic overview of recent developments in the industry. This includes information on industry pricing, costs, and demand. Below you will find a description of what type of business establishments are included in this industry. For information on how to best utilize this industry profile please visit our Business Solutions.

Industry Description

Industries in the Securities, Commodity Contracts, and Other Financial Investments and Related Activities subsector group establishments that are primarily engaged in one of the following: (1) underwriting securities issues and/or making markets for securities and commodities; (2) acting as agents (i.e., brokers) between buyers and sellers of securities and commodities; (3) providing securities and commodity exchange services; and (4) providing other services, such as managing portfolios of assets; providing investment advice; and trust, fiduciary, and custody services.

This industry description was sourced from the North American Industry Classification System.

To download this data, or to learn more about how pricing is measured, please contact us.

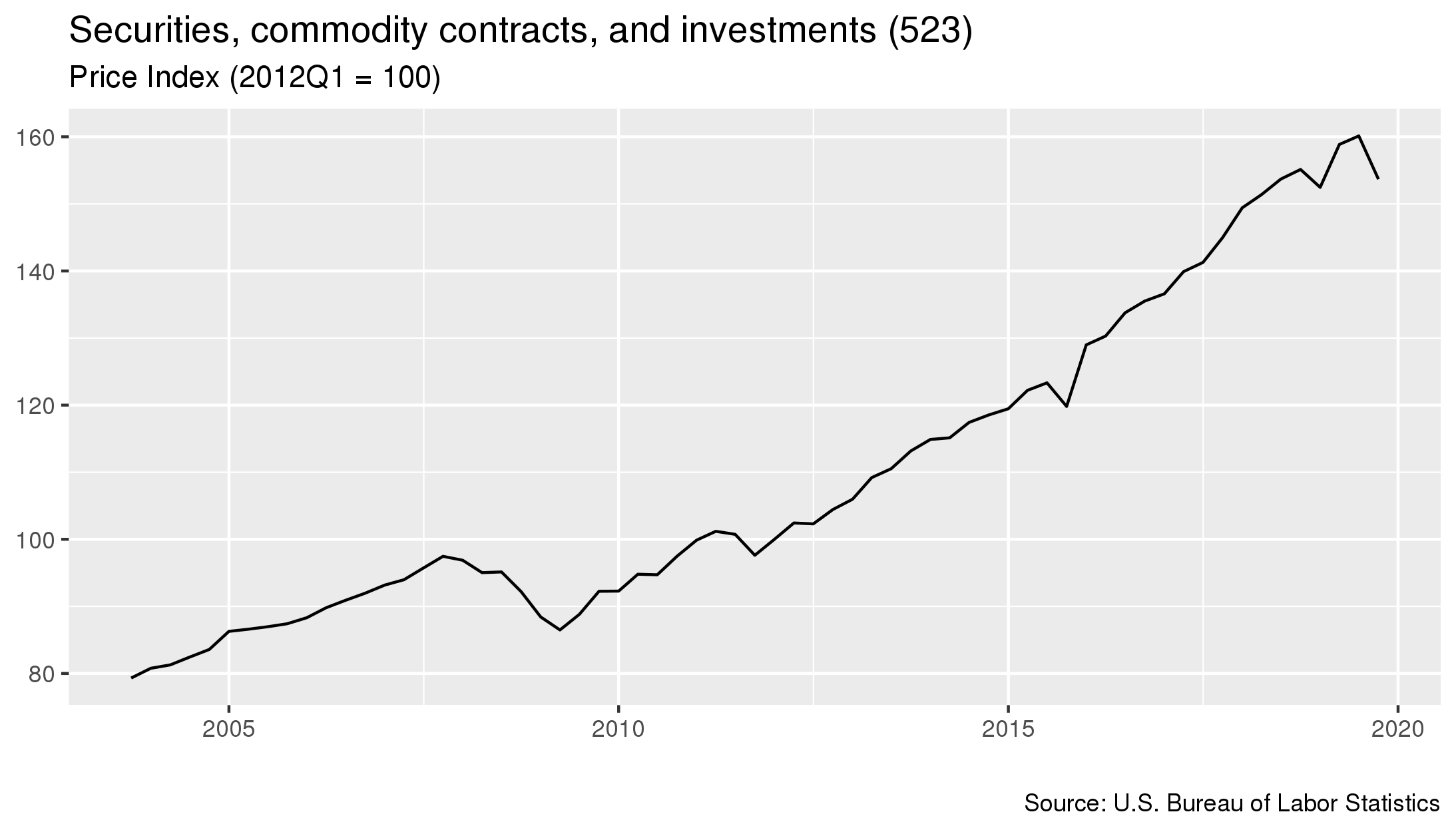

- As of January 2020, prices in this industry had decreased 4 percent since the previous quarter.

- From January 2019 to January 2020 prices in this industry decreased 0.9 percent.

- Prices increased 28.3 percent in the five year period starting in January 2015 and ending in January 2020.

To download this data, or to learn more about how costs for this industry are measured, please contact us.

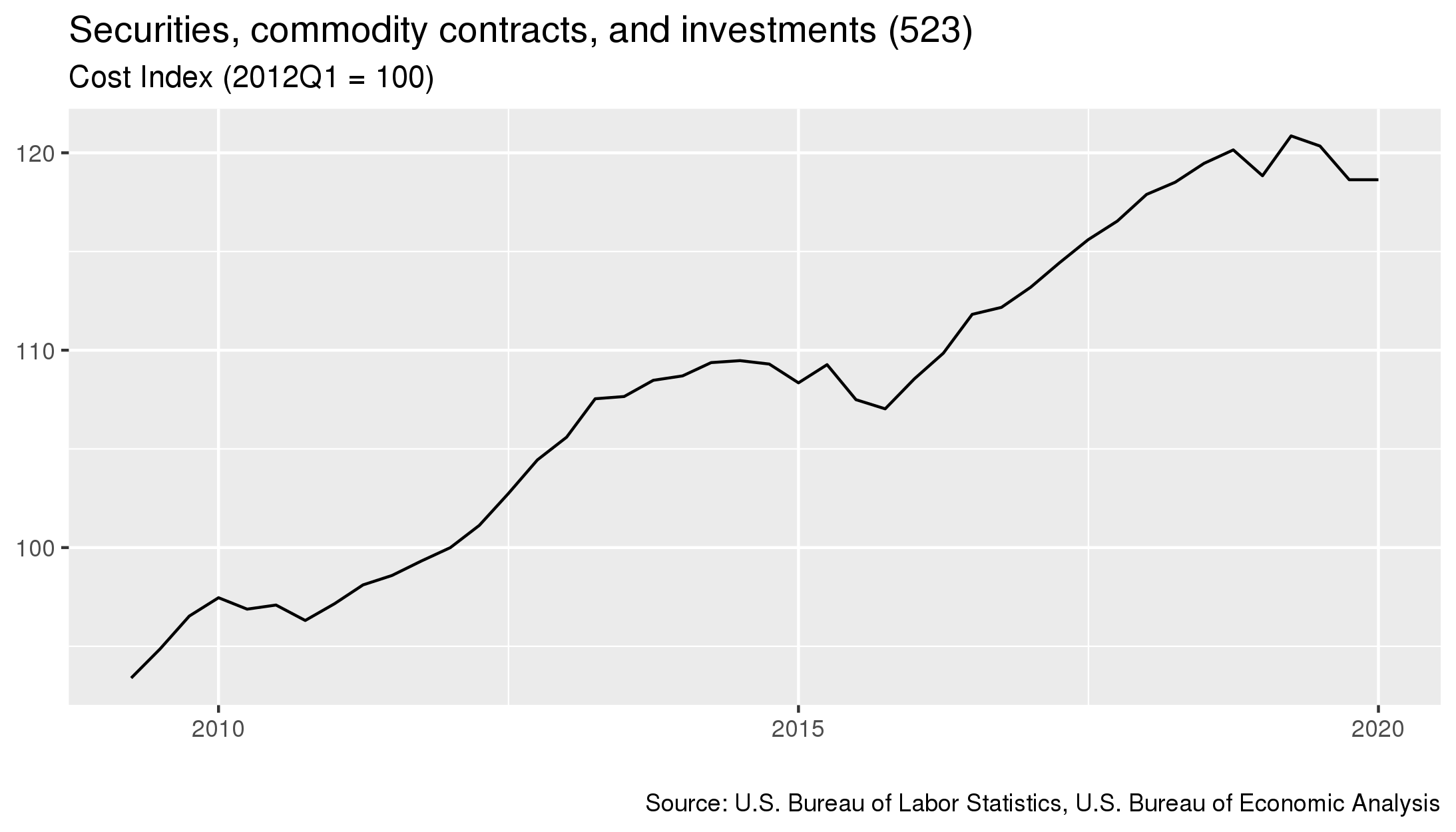

- As of January 2020, costs in this industry had 0 percent since the previous quarter.

- From January 2019 to January 2020 costs in this industry decreased 0.2 percent.

- Costs increased 9.3 percent in the five year period starting in January 2015 and ending in January 2020.

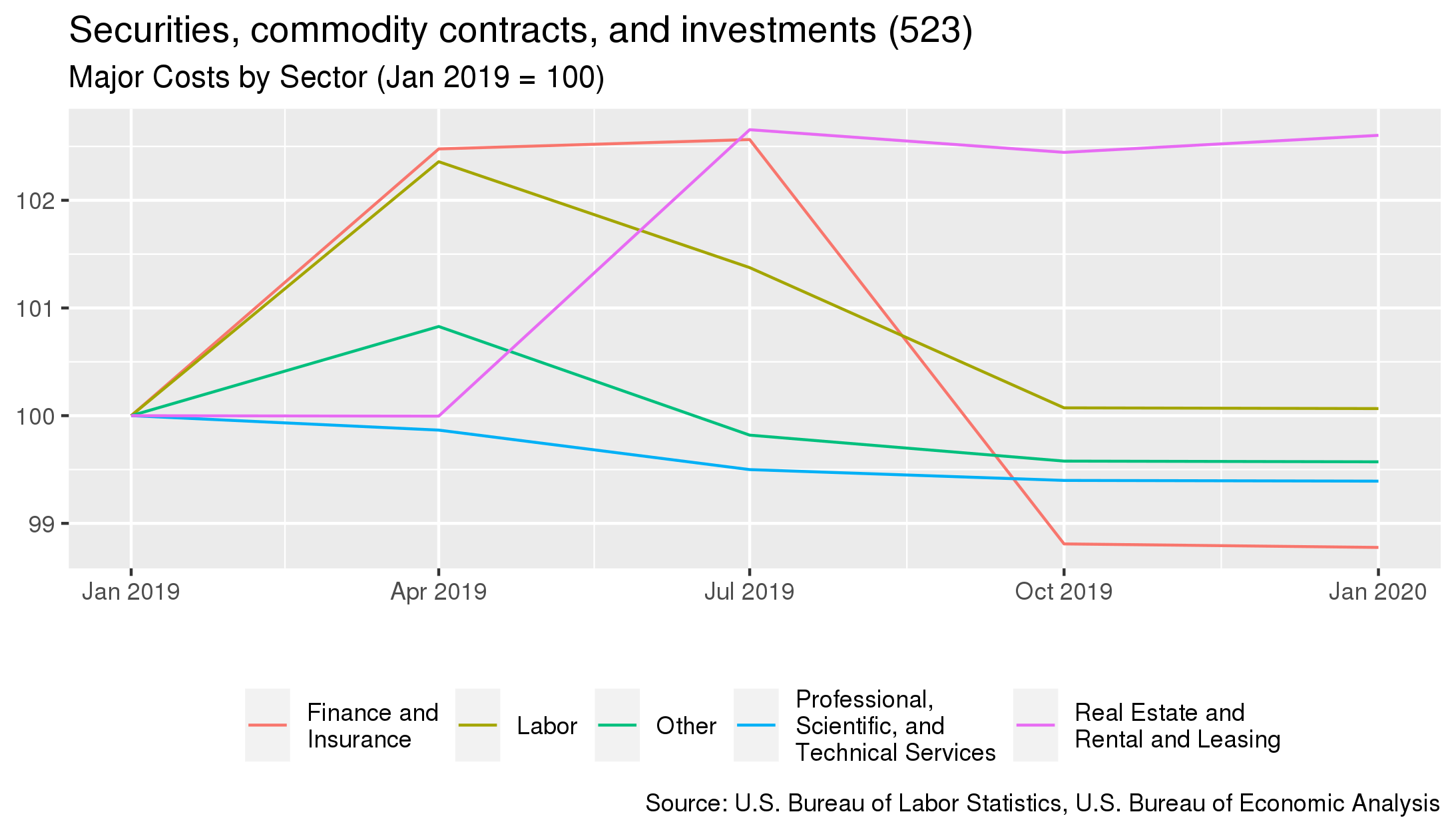

For details on which industries are included in each sector, click here

- The largest cost for this industry is purchases made to the Labor sector. This sector accounts for 41.5% of the industry's overall costs.

- From January 2019 to January 2020, the largest change in costs for this industry were costs associated with purchases to the Real Estate and Rental and Leasing sector. Costs associated with this sector increased 2.6%.

| Sector Name | Percentage of Costs | Annual Percent Change 4 |

|---|---|---|

| Labor | 41.5% | +0.1% |

| Finance and Insurance | 21.2% | -1.2% |

| Professional, Scientific, and Technical Services | 10% | -0.6% |

| Real Estate and Rental and Leasing | 6.7% | +2.6% |

| Other | 5% | -0.4% |

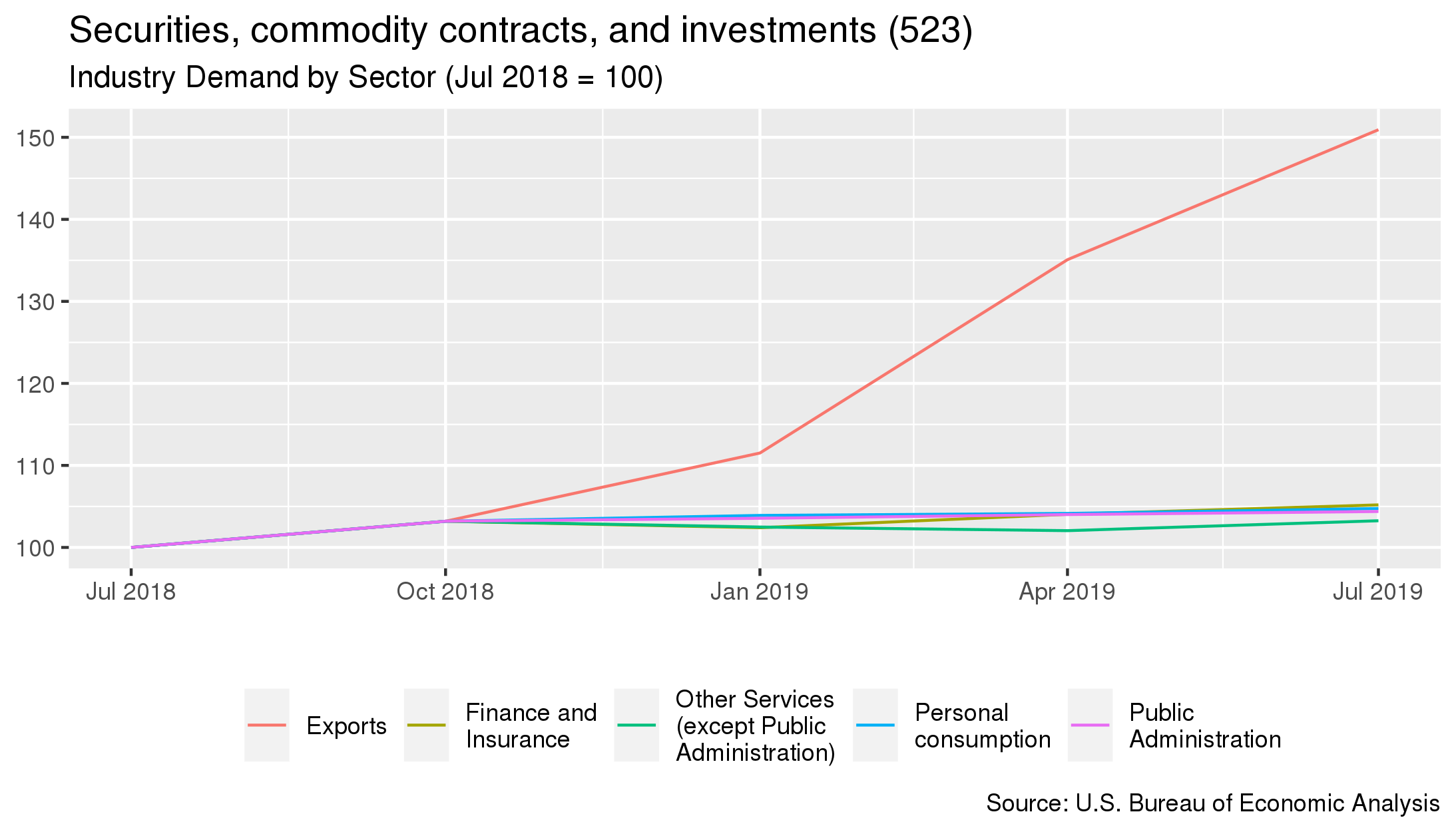

To download this data, or to learn more about how demand for this industry is measured, please contact us.

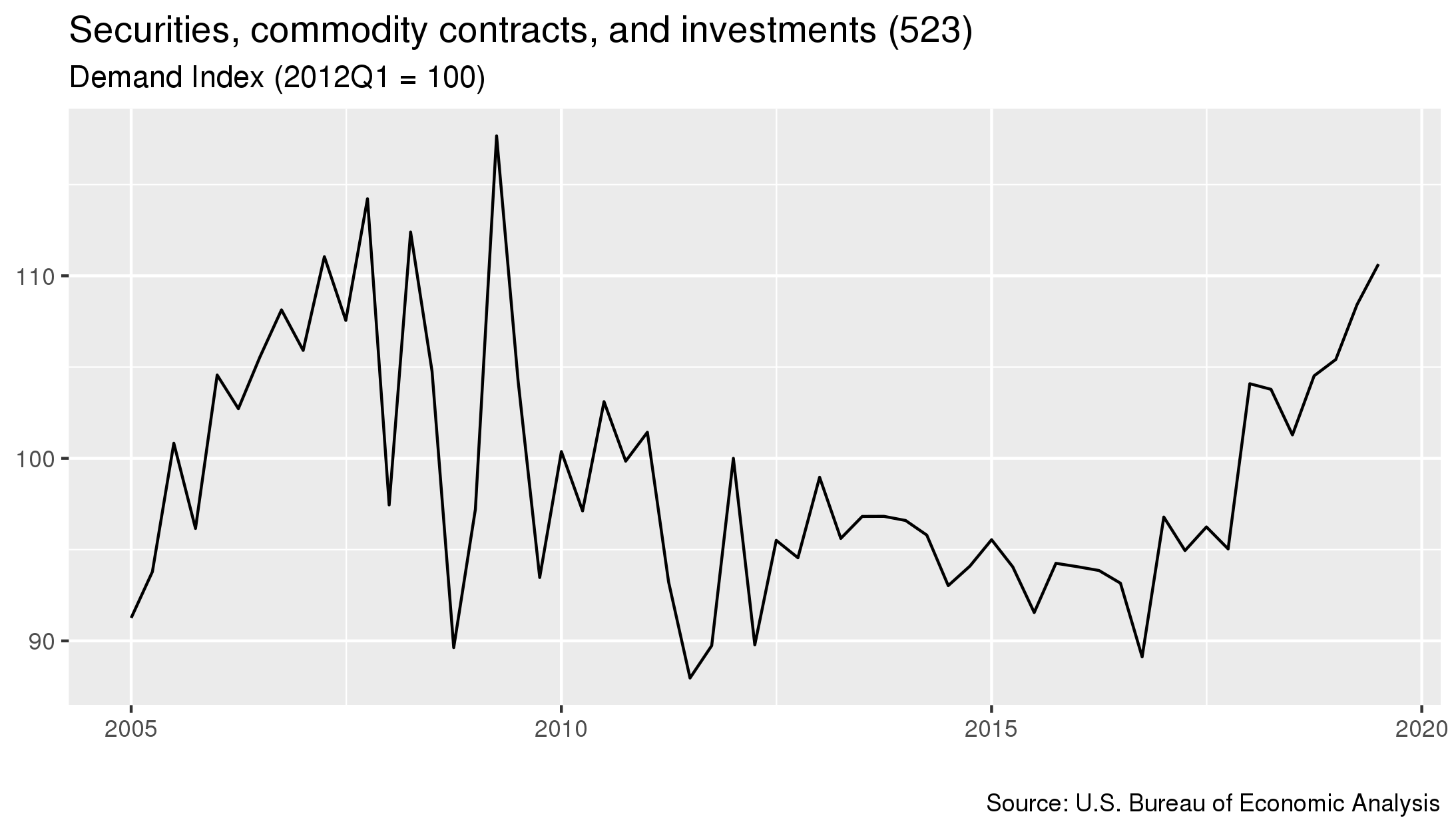

- As of July 2019, demand for this industry had increased 2.1 percent since the previous quarter.

- From July 2018 to January 2020 costs in this industry increased 9.2 percent.

- Costs increased 20.8 percent in the five year period starting in July 2014 and ending in July 2019.

For details on which industries are included in each sector, click here

- The sector that contributes the most to this industry's demand is the Personal consumption sector. This sector accounts for 37% of the industry's overall demand.

- From January 2019 to January 2020, the largest change in demand for this industry was from the Exports sector, where demand increased 50.9%.

| Sector Name | Percentage of Demand | Annual Percent Change 6 |

|---|---|---|

| Personal consumption | 37% | +4.7% |

| Finance and Insurance | 30.2% | +5.2% |

| Exports | 13.4% | +50.9% |

| Public Administration | 4.3% | +4.4% |

| Other Services (except Public Administration) | 2.5% | +3.3% |

- Pricing measured from January 2020.

- The BLS PPI used for this industry is PCU523---523---.

- Costs measured from January 2020

- Demand measured from July 2019